Share this

Stewarding for the Kingdom and Your Family at the Same Time

by Mike Morgan on Sep 8, 2023 12:31:09 PM

As Christians, we are encouraged to both go and share the gospel both here and around the world. It is a “both/and” command. In Matthew 28:19-20, scripture is clear that we are to both go and teach all nations, leading them to Christ and discipling them. That is a clear command and one that has a stewardship component. As we know, it takes money to go, lead, teach and disciple the nations.

Believe it or not, when it comes to money, you can have your cake and eat it too. Let me explain. In God’s economy, you can have “both/and” in your plan. You can plan for both your family and impact the Kingdom with all that He has you stewarding today.

Here is an example of how you can have “both/and” in your plan. I met Bob and Susan a few years ago. They have been long-time supporters of their church and Baptist ministries. Knowing that they wanted to support their family and Kingdom causes when they both went home to be with the Lord, they sought the help of their professional advisors. They had saved and planned for their future and had approximately $750,000 in assets:

- $400,000 in their home, bank accounts and CD’s

- $350,000 in retirement plan/IRA accounts

Bob and Susan were able to live on their social security and savings, while only taking their required minimum distribution (RMD) annually from their IRA’s. They both wanted to provide for their children; however, not all their children managed money in the same way and they knew that there would be income taxes owed by the children if the IRAs were left directly to them as beneficiaries.

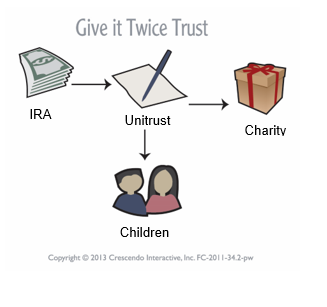

They also wanted to leave part of their estate to their local church and other Kingdom ministries. A “Give it Twice” Trust would help them accomplish their stewardship goals for both their family and the charities that they support today. This “both/and” type of plan is called a Testamentary Charitable Remainder Unitrust, or a “Give it Twice” Trust. This can be an invaluable part of your overall estate plan.

The new Secure Act was recently passed into law, dramatically changing the tax laws concerning how a retirement plan or IRA is left to your beneficiaries. Before the Secure Act, the beneficiary could “stretch” out over a potentially longer number of years the receipt of the account and therefore the tax payments. With the passing of the Secure Act, a beneficiary must now receive the account within 10 years, therefore potentially increasing the income taxes paid on the inherited retirement plan or IRA assets. The “Give it Twice” Trust would allow up to a term of 20 years to make distributions to your beneficiaries, with no tax due upon the transfer of the asset to the trust.

Specific benefits of a “Give it Twice” Trust:

- You can spread out the inheritance to family over a period of time of up to 20 years, instead of the 10-year limit under the new Secure Act.

- You will use the full value of your IRA or retirement plan account after your custodian transfers the full remaining amount of your retirement accounts or IRAs to the trust. No tax payment from these taxable assets is paid at the transfer as the trust is a charitable trust.

- You create an estate tax deduction and savings from the charitable gifts.

- You will leave a lasting legacy with your Kingdom gift. You can choose to benefit your local church and other Baptist ministries, like the Florida Baptist Foundation. after your children have received their distributions.

Kay is both a recent widow and an acquaintance of mine. She and her husband had been faithful givers to their local Baptist church and other Baptist ministries for many years. Kay wanted to provide for her family and for the charities that were near and dear to her and her late husband. Kay had inherited her husband’s retirement plan IRA. She received counsel to establish a “Give it Twice” Trust within her estate plan. At Kay’s passing, the retirement plan IRA will be transferred to the trust and the trust will distribute a percentage of the trust each year, at the most for 20 years, to both her children and then to their church and the Florida Baptist Foundation.

How a “Give it Twice” Trust works:

- Incorporate a Testamentary Charitable Trust into your estate plan.

- Name a trustee to manage, invest and distribute the trust. The trustee can be the Florida Baptist Foundation.

- When you pass away, the assets will be transferred to the trust by naming the trust as the beneficiary of the retirement plan IRA.

- The trust will make distributions to your children or other individual beneficiaries that you designate for their lives or a term up to 20 years.

- After the distributions to the individuals, the balance of the trust would be transferred to the Kingdom organizations that are important to you.

This plan enables you and your family to provide for your children’s inheritance while enjoying both income and estate tax savings with your end gift to the charity or charities of your choice.

This Testamentary Charitable Remainder Unitrust is often funded with taxable assets, like retirement plans or IRA’s. Upon the death of the first or second spouse the assets are transferred by the custodian to the Testamentary Charitable Remainder Unitrust. There are no taxes paid upon transfer. This trust will provide distributions that can be paid to your children for up to 20 years.

After this term, the balance of the trust would be distributed to the charity or charities of your choosing. This will have effectively benefited you, your family, and the Kingdom with the assets that God had entrusted to you.

I have the privilege of meeting with people like Bill, Susan, and Kay, listening and talking with them about not only what all God has entrusted them with over their lifetimes, but also the churches and ministries that are near and dear to their hearts. I believe that God has entrusted his people with all the funds that it would take to accomplish the Great Commission. All we must do is be obedient to His call for what He would have us do, both while we are alive and at the time, He calls us home. It truly is a “both/and” opportunity and one of the greatest honors that I have is to help people accomplish their stewardship desires.

This type of plan may sound new or potentially confusing to you but please do not hesitate to reach out if you would like both more information and help on how a “Give it Twice” Trust might benefit you, your family, and the Kingdom. Feel free to contact me and I will be happy to discuss this Kingdom minded plan with you. I would be honored to serve!

Mike Morgan, CFP®, CKA® is the Vice-President and Chief Operating Officer for the Florida Baptist Financial Services and the Florida Baptist Foundation. You can contact him at (904) 346-0325 or mmorgan@floridabaptist.org.

This information is not intended as tax, legal or financial advice. Please consult your professional advisors concerning the legal, financial or tax questions you may have as they relate to your legal, financial, tax or charitable activities.

Share this

- Sermon (3)

- Trust (3)

- Will (3)

- gifts of stock (3)

- Management Services (2)

- charitable remainder trust (2)

- donor advised fund (2)

- gifts of real estate (2)

- Beneficiary Designation (1)

- Beneficiary Planning (1)

- Blog (1)

- CGIF (1)

- Financial Discipleship (1)

- Generosity (1)

- IRA (1)

- Legacy/Estate Seminars (1)

- Stewardship (1)

- Stewardship Impact Workshop (1)

- charitable gift annuity (1)

- help videos (1)

- life estate (1)

- real estate (1)

- revocable living trust (1)

- unitrust (1)